How the FTX Collapse is Transforming the Crypto Landscape

Written on

The FTX Fallout and Its Consequences

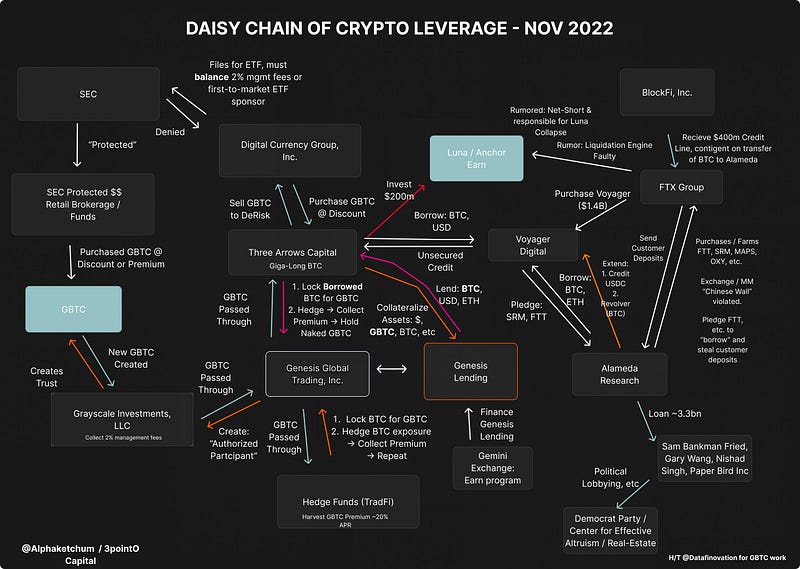

The unexpected failure of Terra in May 2022 triggered a significant downturn in the crypto market, knocking Bitcoin down from $40,000 to $27,000 in a matter of days. Investors with cash reserves eagerly seized the opportunity, believing they were in for a financial windfall. However, this event was merely the beginning of a series of catastrophic incidents that would severely undermine trust in the cryptocurrency sector.

Celsius, Voyager, and Three Arrows Capital soon followed, revealing that leading crypto firms were just as vulnerable as regular DeFi investors. Who could have predicted that?

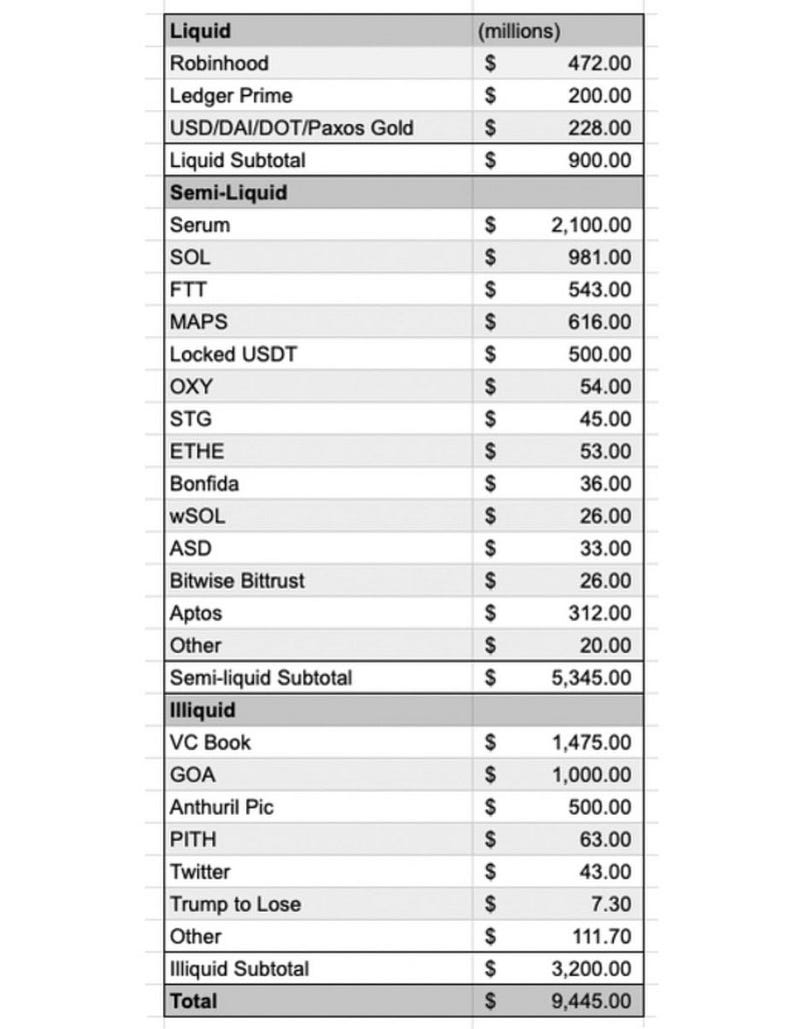

The industry faced a widespread deleveraging; it only took one major failure to set off a chain reaction. The most significant disaster struck in November when FTX, a top-tier exchange once seen as a pillar of stability, revealed liabilities that were tenfold its liquid assets. The ramifications of Sam Bankman-Fried’s FTX empire's collapse are poised to reshape the entire industry, reminiscent of the upheaval witnessed in 2014.

What FTX’s Demise Means for the Future of Crypto

Let's explore the various impacts, each capable of causing setbacks that could last from months to years.

Erosion of Confidence

The crypto sector's trust has plummeted to unprecedented lows. For the industry to thrive, it needs capital from traditional finance (TradFi) to invest in innovative projects. If potential investors observe the chaos within the crypto space, they may hesitate to invest, especially institutions with a low risk tolerance.

The Advantage for Traditional Finance

Wall Street is reveling in this turmoil. Major TradFi players, who previously dabbled in cryptocurrencies, are now eyeing the weakened sector, eager to exploit its vulnerabilities. Recent advertisements from firms like Fidelity exploit investors' fears about unregulated exchanges, positioning banks as the safe and convenient entry points into crypto.

A Diminished Liquidity Pool

With FTX's collapse, billions in liquidity that once fueled the industry vanished almost overnight. As one of the top three exchanges, FTX was a major source of liquidity, and its absence will leave a significant void for the foreseeable future.

FTX has filed for Chapter 11 bankruptcy, and its assets are now under the control of liquidators. This situation is reminiscent of the Mt. Gox collapse back in 2014.

Startups on a Tight Budget

Startups in the crypto space often operate with limited funding, known as their runway. Many projects had their treasuries tied up in FTX, and now, with those funds inaccessible or possibly lost, their ability to grow is severely compromised. Running out of money remains one of the leading causes of startup failures.

Venture Capital Losses

The industry's incubators have faced considerable setbacks. Venture capitalists dedicated to advancing the sector have incurred substantial losses, either due to investments in FTX or funds locked on its platform. For instance, Multicoin Capital, a key investor in Solana, reported a staggering 55% decline in its flagship fund's capital due to FTX's fall, with 15% of its funds still trapped on the exchange.

Solana's Plight

The situation is particularly grim for Solana supporters. Through Alameda and FTX Ventures, Bankman-Fried backed numerous projects within the Solana ecosystem since 2019, including a significant $320 million investment in Solana Labs in July 2021. The collapse of FTX has dismantled a crucial support system for Solana.

The first video delves into how the events leading to FTX's collapse could have been avoided, providing insights into the crypto landscape.

Can Solana Endure?

Reflecting on the situation, I ask: Did Multicoin Capital and Sam Bankman-Fried provide enough support to foster the Solana ecosystem? Has their investment created sufficient momentum for Solana to thrive?

I believe the answer is affirmative.

#### Technological Edge

Solana boasts remarkable throughput, enabling the development of projects that may only function on its blockchain. This exceptional capability has attracted some of the most innovative crypto startups.

#### NFTs and Adoption

While Solana was initially designed to challenge high-frequency trading in traditional finance, it has emerged as a significant player in the NFT space, second only to Ethereum. With NFTs poised to drive mass adoption in Web3, Solana's ecosystem may experience substantial growth in the upcoming bull market.

#### Diverse Use Cases

Numerous exciting projects are being developed on Solana, such as:

- Audius: A decentralized music streaming platform akin to Spotify.

- Helium: A service allowing users to become their own wireless providers.

- Hivemapper: A project rewarding users for contributing to a global mapping initiative.

- Render: A decentralized GPU rendering service essential for the metaverse.

- STEPN: A gamified fitness app rewarding users for staying active.

- Teleport: An Uber-like service enabling direct connections between drivers and riders without a middleman.

These diverse applications have the potential to disrupt existing business models and challenge entrenched players in Web2.

The second video highlights why buying Solana post-FTX crash could have been one of the best investment decisions.

Conclusion

The FTX incident marks yet another major disruption in the crypto sector this year. However, two silver linings emerge.

First, concerns about Solana's viability may be overstated. The ecosystem, built on impressive technology, is still developing.

Second, while Solana faces significant challenges ahead, including a staggering 95% drop in token value and total value locked (TVL) in smart contracts, there are signs of resilience. Development activity appears to be rebounding despite the declining token price, indicating potential for recovery.

As the crypto landscape evolves, it’s crucial to focus on the fundamental signals rather than the noise. The industry is still nascent, characterized by rapid innovation alongside failures and corruption. The downfall of FTX is part of the maturation process for the crypto ecosystem.

More individuals are beginning to understand the advantages of a decentralized financial system, akin to the historical separation of religion from state. The rise of self-custody Web3 wallets empowers users, showcasing the true potential of decentralization.

In this transformative era, Web3 continues to attract significant investment, paving the way for a new era of financial freedom.