Embracing Change: Why Your Bitcoin Hesitation Reflects a Wider Issue

Written on

Chapter 1: The Nature of Fiat Money

Governments have effectively diminished the value of fiat currency, treating it as disposable as the wet end of a cigarette. Fiat money, which derives its worth solely from governmental decree rather than intrinsic value, can resemble a large-scale Ponzi scheme. Its value lies in collective agreement and usage, yet it offers no tangible benefits.

Bitcoin and blockchain technology are transforming our flawed financial systems into something significantly more robust. Here are a few compelling advantages of Bitcoin:

- Its supply is fixed at 21 million, making it inherently scarce.

- Bitcoin is durable and supported by a global network of computers.

- It cannot be forged or counterfeited.

- As a digital asset, it boasts exceptional portability.

- Transactions occur without intermediaries, reducing the chances of human error or corruption.

- You can send substantial amounts globally for mere fractions of a penny.

The only barrier to Bitcoin's functionality would be a global internet outage, which would pose significant challenges for everyone involved.

While traditional fiat systems have provided a semblance of stability, many question the necessity of cryptocurrency when the current system seems to work. However, the underlying issues render it fundamentally flawed. Fiat currency can be damaged, forged, or destroyed; the supply is neither limited nor accurately tracked, and its settlement systems are sluggish—especially for international transactions that can take several days to process. Additionally, exorbitant fees often render it ineffective for those in low-income countries.

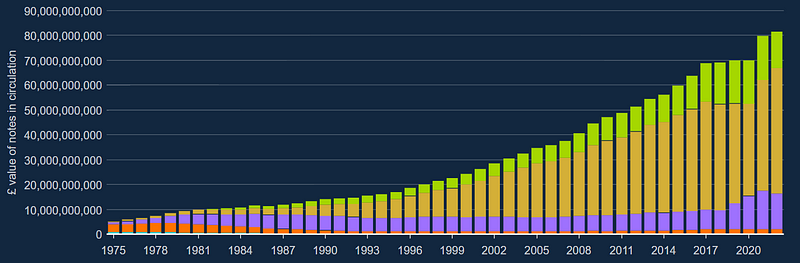

The centralized nature of fiat money opens the door to corruption, especially in developing nations. According to the Bank of England, money supply has more than doubled since 2016, with no signs of a slowdown in the printing of new banknotes:

- 2013: 10.4 million

- 2016: 15.2 million

- 2021: 33.6 million

Chapter 2: Resistance to Technological Change

Technology often faces criticism before its widespread acceptance. The truth is, people do not have a Bitcoin problem; rather, they struggle to adapt to change and the mental shifts required to embrace new technologies.

Historically, new innovations have faced resistance. For instance, the introduction of the printing press met with backlash from religious groups, while farmers resisted the use of tractors. Mobile phones were initially perceived as luxuries for the wealthy, and social media was seen as a playground for the youth.

In his book, "Innovation and Its Enemies: Why People Resist New Technologies," Calestous Juma, a Harvard Kennedy School professor, explains that opposition arises from a perception of risk in the short term, with benefits seemingly accruing only to a select few in the long term. This skepticism is fueled by a distrust in public and private institutions, particularly when the innovations threaten established norms.

Juma states, “The benefits of new technology often appear to be concentrated among a small segment of society, while the associated risks are perceived to be more widespread.” This perception can lead to public disapproval unless the technology aligns with individuals' interests or enhances their standing.

Innovations are more readily embraced when they resonate with our desires for inclusion and purpose, even if they are initially cumbersome or costly.

For example, the initial introduction of tractors provided only marginal improvements over traditional methods, yet over time, they became accepted as essential tools of modern agriculture.

Bitcoin Changed My Life When I Took This Risk!

In this video, the speaker shares a personal journey of how taking risks with Bitcoin profoundly transformed their life, shedding light on the opportunities cryptocurrency offers despite common apprehensions.

Chapter 3: Bitcoin's Rapid Adoption

Blockchain technology is the fastest-growing innovation in human history. Since its emergence, Bitcoin has outpaced even the internet in terms of adoption, with estimates suggesting it could reach 1 billion users within four years.

Regardless of personal opinions about Bitcoin—be it enthusiasm or skepticism—there is no denying that this technology will play an integral role in our lives moving forward. This is an inevitability we cannot escape.

However, there are improvements needed for Bitcoin to achieve widespread acceptance. For instance, proof-of-work networks must address their environmental impacts to gain broader acceptance. Failure to do so could lead to governmental restrictions on mining activities, ultimately capping the supply at 18 million.

Making blockchain technology less technical and more user-friendly will also be essential to inclusivity.

We will navigate these challenges, whether through innovative means or by revisiting traditional methods.

Bitcoiners Are Waking Up To The BTC Hijacking

This video discusses the emerging awareness among Bitcoin enthusiasts regarding the potential risks of Bitcoin centralization and the implications it may have for the future of cryptocurrency.

Final Thoughts

The journey towards embracing blockchain technology mirrors that of earlier innovations. The path may be fraught with challenges, but history shows us that acceptance often follows initial resistance.

For further insights on Web3, consider supporting independent writers by becoming a member. A small commission may be earned through your membership via my link.

Please note: This article is for informational purposes only and should not be interpreted as financial, legal, or tax advice. Always consult a professional before making significant financial decisions.

Subscribe to DDIntel Here.