Navigating Bitcoin: Understanding Its Role as an Investment

Written on

Chapter 1: Bitcoin as an Investment

Bitcoin should be viewed as an investment rather than a trading asset. It serves as a long-term store of value and acts as a hedge against the existing financial systems. Unlike trading, which may have been profitable during Bitcoin's rise from 2011 to 2017, it is now more prudent to consider Bitcoin as a stable investment for the select few rather than a quick profit opportunity for the masses.

Moreover, Bitcoin is not a get-rich-quick scheme; instead, it represents a strategy to avoid gradual financial loss.

Bitcoin's Youth and Resilience

Bitcoin emerged in the wake of the 2007-2008 financial crisis, making it just over a decade old—relatively young in the investment world. Each year it continues to exist reinforces its position as a long-term store of value.

A historical milestone occurred on May 22, 2010, when Laszlo Hanyecz famously purchased two pizzas for 10,000 BTC, marking what is now celebrated as Bitcoin Pizza Day. At that time, Bitcoin held little value, and it wasn't until the 2011 rise, particularly with the short-lived Mt. Gox exchange, that it gained a significant market value consensus.

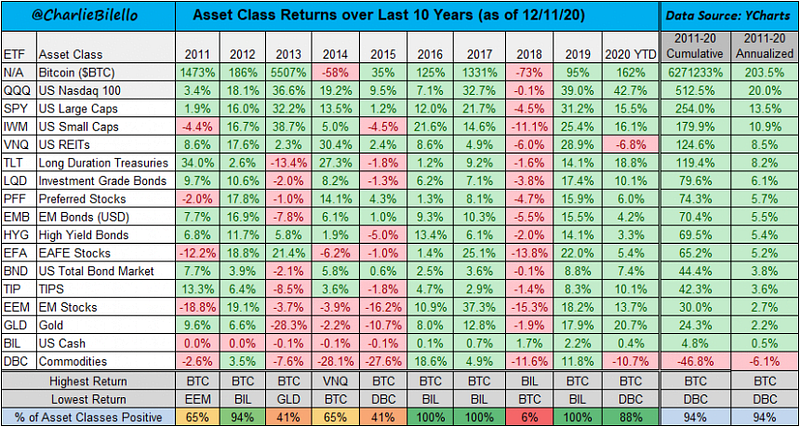

Despite its youth, Bitcoin has outperformed other assets over the past decade, returning over 200% annually. In early 2021, it also crossed the $1 trillion market capitalization milestone, indicating it is still in a growth discovery phase.

For more insights like this, consider subscribing to my newsletter.

Bitcoin's Volatility: A Double-Edged Sword

While Bitcoin averages a remarkable 200% return year-over-year, it is undeniably a volatile asset that may not suit everyone. However, dismissing Bitcoin solely due to its volatility would be unwise. The upward swings in its price can be immensely valuable.

Bitcoin experiences market cycles, and we may currently be in the midst of a “supercycle.” This means that while historical trends show Bitcoin transitioning through periods of bullish and bearish sentiments, the current landscape suggests a prolonged bullish phase due to heightened interest and user adoption.

Dan Held, a prominent figure in the Bitcoin community, proposes a thought-provoking perspective: Bitcoin may not be as volatile as it appears, but rather a stable asset when considering its underlying protocol, which boasts an impressive 99.98% uptime. It thrives without support from traditional financial institutions, highlighting the unpredictable nature of external market factors rather than Bitcoin itself.

Day Trading: A Risky Endeavor

Day trading is not a strategy suited for the majority. This is not financial advice, but it’s advisable to refrain from attempting to capitalize on Bitcoin’s price fluctuations. Given Bitcoin's impressive performance and growing institutional backing, it is better regarded as a long-term store of value, akin to digital gold.

The crypto community refers to the practice of accumulating Bitcoin over time as "stacking sats." Trading for immediate profit is challenging, even for seasoned investors, as accurately predicting market peaks and troughs is incredibly difficult, especially in a rapidly evolving industry.

How to Invest in Bitcoin

So, how should one approach Bitcoin? Completely ignoring this revolutionary asset means potentially missing out on a significant financial opportunity akin to the Internet boom.

For those interested in investing, dollar-cost averaging into Bitcoin over time is a recommended strategy.

If you are still intrigued by the idea of “trading” Bitcoin, consider looking at related assets that are more traditionally traded. Numerous publicly listed companies hold Bitcoin on their balance sheets or engage in Bitcoin mining. Researching “Bitcoin stocks” can offer alternative investment avenues.

While this isn’t financial advice, it’s worth noting that many individuals struggle to profit from day trading stocks as well. Long-term strategies, such as dollar-cost averaging, tend to be more effective for the average investor.

Bitcoin: The Future of Investment

Ultimately, Bitcoin represents an investment that is introducing a new era of accessible and versatile monetary assets. Often referred to as "gold 2.0," Bitcoin appears to be here for the long haul. Contrary to common misconceptions, Bitcoin is already subject to significant regulatory scrutiny in the U.S., with agencies like the Office of the Comptroller of the Currency (OCC) and the Internal Revenue Service (IRS) providing guidelines for its use and reporting.

As the global community continues to assess its relationship with Bitcoin, long-term holders, or HODLers, can find comfort in the notion that Bitcoin will endure despite its fluctuations and the surrounding media narratives.

Thank you for reading this discussion on Bitcoin! This is not financial advice—merely insights into Bitcoin’s role in the financial landscape. I welcome your thoughts on the subject.

The first video, "Bitcoin Is Not Looking Good... Here's What You Need To Know," explores the current state of Bitcoin and its potential implications for investors.

The second video, "Crypto Is F*cked...," discusses the challenges facing the cryptocurrency market and what it means for the future.