# Mastering Personal Finance: Insights from Dave Ramsey on Market Timing

Written on

Understanding Market Timing

The anxious part of you needs to stop believing that the financial world is collapsing.

Photo By Bites and Sites on Flikr

AI-assisted technology utilized

Behind every exceptionally successful individual is often a partner with immense patience.

Despite achieving significant success as a real estate investor, Dave Ramsey faced bankruptcy in the early 1980s. Along with his wife, Sharon, he experienced financial hardships, identifying the fundamental problem as straightforward: avoid borrowing beyond your means and refrain from spending more than you earn. Ramsey's guiding principle is to abstain from debt altogether.

Regrettably, our culture has become accustomed to a reckless debt mindset, mistakenly believing that monetary systems can endure indefinitely. Once boasting a net worth exceeding a million and a flourishing real estate portfolio, Ramsey's financial stability crumbled when the market collapsed, leading banks to call in their loans and foreclose on him, resulting in a staggering debt that devastated his assets. Consequently, he was forced to declare bankruptcy.

Ramsey is candid about his bankruptcy experience, using it as a cautionary narrative for others. During their financial downfall, he and Sharon had to drastically alter their lifestyle, selling furniture and driving vehicles that were 10-20 years old to save money. There was even a time when their car broke down, and Dave had to utilize his mechanical skills to resolve the issue instead of incurring repair costs.

With his hard-earned wisdom, Dave has emerged as one of the foremost personal finance experts globally. He assures us not to fret over the current stock market conditions. If you're feeling anxious, it's a typical reaction, but it may stem from an emotional response that requires a more analytical approach.

Investing for the Long Haul

Now is not the time to attempt to time the market; rather, Ramsey encourages you to "just get in." Historically, if your investments are well-diversified, market trends tend to rise over time.

The key is to stay the course. Let’s explore the details:

Individuals who attempt to time the market often perform worse than those who maintain their investments. Ramsey points out that emotional impulses drive investors to exit when markets decline and re-enter when they rise, which ultimately undermines their financial performance. Conversely, those who commit to staying invested generally see better results than those who try to catch market fluctuations.

Ramsey aptly illustrates his point by saying, “Nobody gets hurt on a roller coaster except those who jump off in the middle!”

He elaborates, “Extensive data exists that analyzes the stock market's history and the behaviors of those attempting to time it. People often react emotionally, exiting when the market dips and re-entering when it surges.” The math significantly shifts, emphasizing the importance of remaining in the market.

When the market is down, it's an ideal opportunity to invest, as historically, the year that follows is typically profitable. According to Ramsey, the market is currently "on sale," much like the discounts one would find at Kmart during his childhood.

Behavior Over Knowledge

Ramsey debunks the prevalent myth that all investors lost everything during the 2008 financial crisis. He clarifies that it's mathematically impossible to lose everything when invested in mutual funds unless all assets were tied to a single stock that went bankrupt. In actuality, the market only fell by 50% during that time, meaning that even if someone sold at the bottom, their losses would be halved.

He emphasizes, “The essence of personal finance is 80% behavioral and only 20% knowledge.” Over the years, Ramsey has learned to manage his inner anxieties by relying on data rather than succumbing to emotional turmoil. He reminds himself that the historical evidence supports the idea that remaining invested is advantageous, regardless of political or economic turmoil.

The Data Behind Staying Invested

Numerous studies have demonstrated that investors who remain invested outperform those who attempt to time the market. For instance, DALBAR Inc.'s “Quantitative Analysis of Investor Behavior” revealed that from 1998 to 2018, the average investor's annual return was only 5.19%, while the S&P 500 yielded 9.85%. Investors often miss gains by buying and selling at inopportune moments.

Similarly, research from Morningstar indicated that those who maintained a diversified portfolio of stocks and bonds outperformed market timers from 1993 to 2013, with the S&P 500 achieving a 9.22% annualized return compared to a mere 2.53% for the average investor. A Vanguard study also highlighted that investors who stayed the course during the 2008 crisis fared better, with the S&P 500 returning 8.49% annually from 2008 to 2018, whereas the average investor returned only 6.1%.

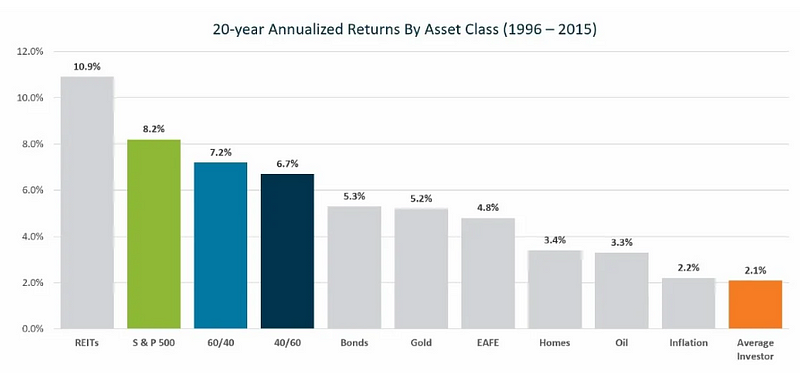

The data consistently shows that individuals often cease investing during market downturns, missing out on potential discounts. However, fear tends to dominate decision-making processes. OneDigital's findings reveal that over 20 years ending in 2015, the S&P 500 delivered an 8.2% average return, while the average investor only achieved 2.1%, failing to even surpass inflation, which averaged 2.2%.

Source — onedigital.com

Concluding Thoughts

I often receive feedback on my blog posts, most of which revolve around timing the market. While readers may not explicitly express this in comments, many are concerned about whether now is a favorable time to invest.

Dave Ramsey dismisses this notion, explaining that what you're experiencing is simply part of a regular market cycle. Human behavior often follows predictable patterns when it comes to investing. Research by James Montier and Philip Pilkington illustrates that investors typically navigate through four emotional stages: optimism, excitement, anxiety, and depression. These phases, shaped by sentiment and market behaviors, can lead to bubbles and crashes.

The vital takeaway is to separate your emotions from investment decisions and market fluctuations. Human unpredictability often leads to a fear of loss. Unless you're a professional trader, it may be more beneficial to invest and then allow your diversified portfolio to grow over time.

So, stop letting the anxious part of you dictate your actions. Take the leap and stay invested.

For more insights from leading experts in Crypto, Business, Finance, and Technology, join my Substack for daily updates, completely free of charge.

This article serves informational purposes only and should not be interpreted as financial, tax, or legal advice. It's advisable to consult a financial expert before making significant financial choices.

Subscribe to DDIntel Here.