Crypto Market Insights: Analyzing Recent Trends and Updates

Written on

Chapter 1: Current Market Landscape

The atmosphere in the cryptocurrency market feels quite somber at the moment. The wider financial markets are facing challenges, and altcoins are experiencing notable declines. However, there are various factors that warrant our attention. Key metrics still indicate resilience, long-term holders are continuing to accumulate assets, and significant investments are still entering the crypto space, such as the recent involvement from Google.

Is this a cause for concern? It's crucial to keep in mind that prices can be unpredictable and influenced by numerous factors, but the overall context suggests a different narrative.

Section 1.1: The Rise of DAOs

Decentralized Autonomous Organizations (DAOs) are gaining traction on social media platforms. They could very well become the standout trend of 2022, akin to how NFTs dominated the previous year.

With heightened interest, there's also a risk of encountering subpar projects. It's essential to proceed with caution.

Subsection 1.1.1: Insights from Delphi Digital

Delphi Digital, a prominent analytics firm in the crypto space, has recently published a chartbook report that offers a comprehensive analysis of the cryptocurrency market. In this newsletter, I'll summarize several key takeaways from this insightful document.

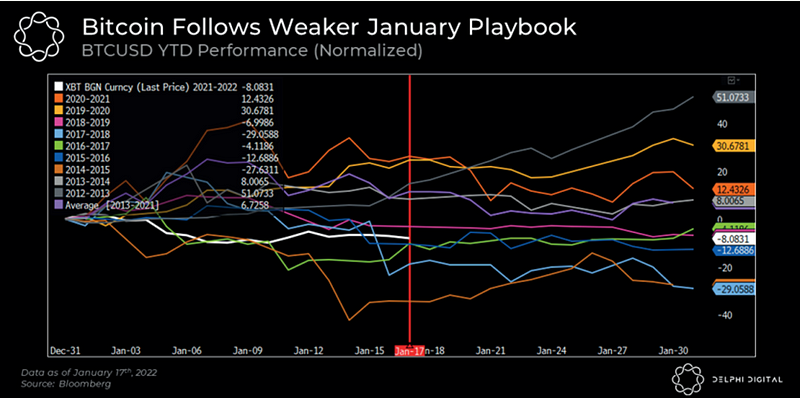

Historically, Bitcoin tends to struggle in January, as highlighted by data from Delphi Digital. The average performance of Bitcoin during January from 2013 to 2021 is a modest +6.7%.

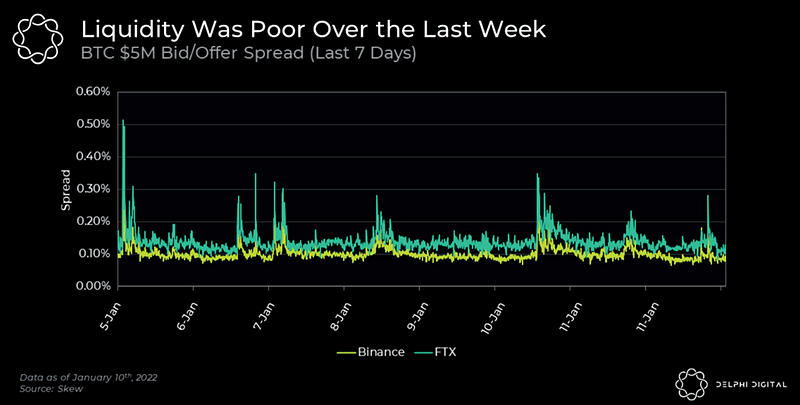

Additionally, a lack of liquidity in perpetual and Bitcoin futures markets has amplified this weakness. As stated in the report, extreme price fluctuations are often seen in low liquidity environments.

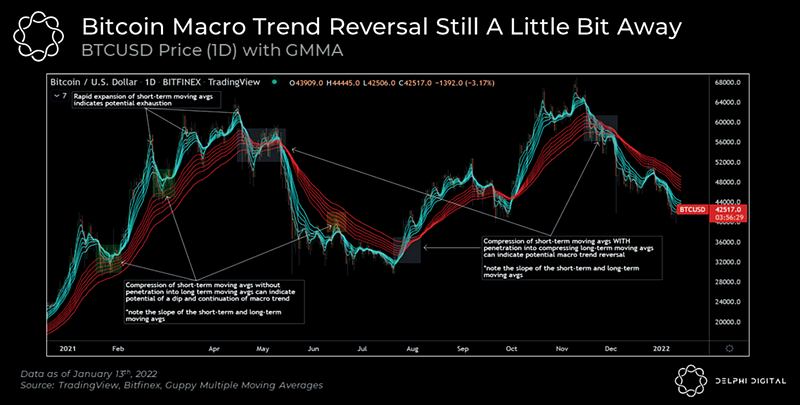

The Guppy Multiple Moving Averages (GMMA) chart suggests that a trend reversal may still be on the horizon. Compression in short-term moving averages typically signals exhaustion, and when these averages cross into longer-term averages, a potential shift in trend could be imminent.

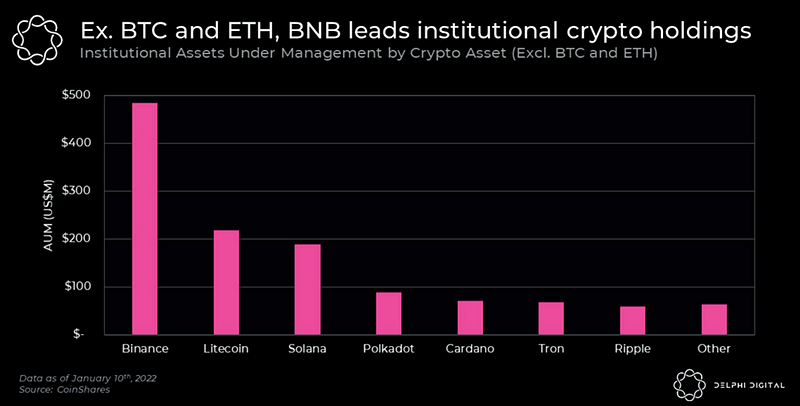

Bitcoin and Ethereum remain the primary focus of institutional interest, significantly outpacing other assets. Following them are Binance, Litecoin, and Solana, with DOT, ADA, and TRON also making notable appearances in the top charts.

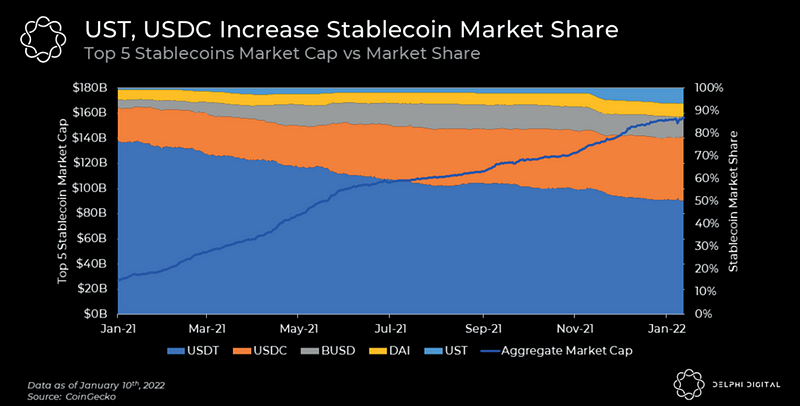

UST, the leading decentralized stablecoin by market capitalization, is steadily closing the gap with USDT and USDC issued by Circle. It’s worth noting that LUNA is utilized to mint UST.

Chapter 2: Current Market Update

Bitcoin (BTC) is currently trading within a narrow range around the 40–42k support level. In light of the current stock market fluctuations, Bitcoin is managing to maintain this support while the broader markets adapt to what could be termed the "new normal." Bitcoin finished the day at 41.7k, reflecting a decrease of 1.64%.

Bitcoin Dominance (BTC.D) concluded the day at 40.51%, remaining close to its yearly lows despite the prevailing market conditions.

Notable Gainers

- LOOKS: $5.72 (+16%)

- GLMR: $10.19 (+10%)

- GMX: $59.28 (+14%)

- DAO: $4.36 (+15%)

The Bitcoin Fear and Greed Index currently sits at 24, indicating extreme fear among investors. Google Trends for "Bitcoin" shows a score of 24. The maximum pain for Bitcoin options set for January 20 is at 43K.

Section 2.1: Major Developments in Crypto

Block's Cash App is set to incorporate the Bitcoin Lightning Network, enabling users to send and receive Bitcoin without transaction fees.

Furthermore, the Luna Foundation Guard (LFG) has been established to maintain the peg stability of Terra's stablecoins and foster ecosystem development, receiving an initial allocation of 50 million LUNA, valued at approximately $4 billion from Terraform Labs.

THORchain is introducing DeFi yields and swaps for DOGE, expanding its offerings.

In an exciting development, Google and a16z have co-led a $20 million investment in the African Web3 game publisher, Carry1st.

However, it was recently disclosed by Crypto.com (CRO) that 400 customer accounts were compromised in a hack. The CEO, Kris Marszalek, confirmed that all affected accounts have been reimbursed. Following the incident, Crypto.com temporarily halted withdrawals for 14 hours, with $15 million in Ether reported stolen.

Google Pay has also hired a former PayPal executive to spearhead its efforts in crypto payments, reflecting the conglomerate's growing interest in the sector.

Notable Events

- SundaeSwap (SUNDAE) will launch its mainnet tomorrow; keep an eye on Cardano (ADA) for updates.

- Near Protocol (NEAR) is hosting a Town Hall meeting tomorrow at 9 AM EST.

- Sologenic (SOLO) will distribute the SOLO/XRP airdrop to holders at 8 PM (UTC) tomorrow.

Weekly Watchlist

- Cardano (ADA)

- Polygon (MATIC)

- Harmony One (ONE)

- Fantom (FTM)

Thank you for engaging with this report! Your support is invaluable; if you find this content beneficial, consider pressing the clap button below to support my writing (up to 50 times!).

Gabi

Follow me on Twitter and Medium, or subscribe to this FREE daily newsletter on Substack. To fully benefit from this newsletter, it's advisable to read it daily to keep abreast of the crypto markets. This practice will position you among the top 2% of informed market participants, revealing opportunities that may not be obvious to others. The newsletter condenses hours of daily research on charts, on-chain metrics, news, and emerging narratives into a quick 5-minute update. It’s my way of giving back to a crypto community that has greatly enriched my knowledge.

Join the Coinmonks Telegram Channel and YouTube Channel to learn more about crypto trading and investing.