Breaking the Cycle of Financial Instability: Key Strategies

Written on

Chapter 1: Understanding Financial Instability

Achieving financial stability is often viewed as a distant dream reserved for those with considerable wealth. However, the truth is that a healthy financial life is more about one’s habits and mindset than sheer income. Among the various detrimental behaviors that lead to financial distress, inadequate money management stands out as the most significant. This article explores the ways poor financial habits entrench individuals in poverty and provides actionable methods to escape this cycle.

Section 1.1: The Nature of Poor Money Management

Inadequate money management includes several behaviors and attitudes that hinder financial progress. Some key indicators of poor management are:

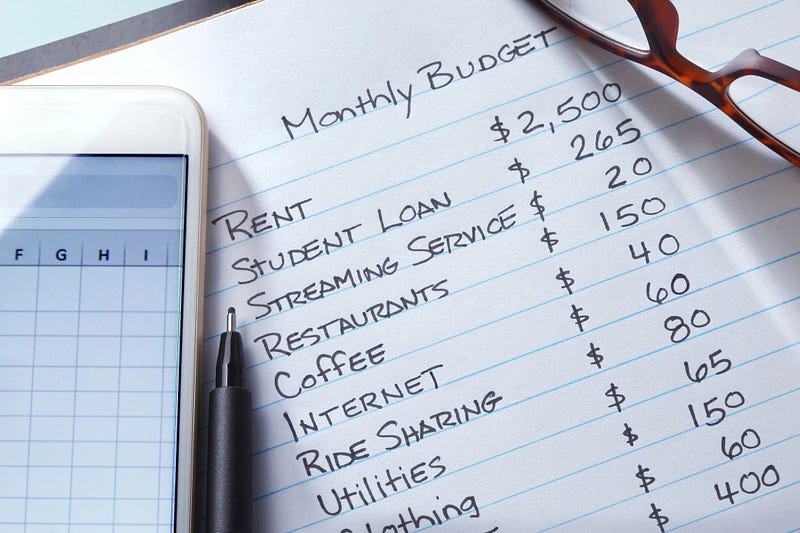

- Absence of Budgeting: Not having a budget or failing to adhere to one is a widespread issue. A budget is essential for monitoring income and expenses, helping prevent overspending.

- Impulse Purchases: Making spontaneous purchases driven by emotion rather than need can destabilize finances. This habit can swiftly drain savings and elevate debt levels.

- Excessive Debt: High levels of debt, particularly from high-interest sources like credit cards, can be overwhelming. The burden of interest payments limits the ability to save and invest.

- Neglecting Savings: Failing to save for emergencies or future needs leaves individuals susceptible to unforeseen expenses, leading to further debt.

- Living Beyond One’s Means: Regularly spending more than one earns creates ongoing financial turmoil, often resulting in the need to use credit to cover daily expenses.

Section 1.2: The Cycle of Financial Instability

Poor financial management fosters a cycle of instability. Here’s how this cycle typically operates:

- Overspending and Debt Accumulation: Without a budget, individuals are prone to overspending, which leads to debt. The resulting interest further exacerbates financial pressure.

- Inability to Save: High monthly debt payments diminish the capacity to save. Without savings, unexpected costs lead to additional borrowing.

- Increased Financial Stress: Constant financial anxiety can take a toll on mental and physical health. This stress often leads to poor decision-making, worsening financial conditions.

- Missed Opportunities for Wealth Building: Limited savings hinder investment opportunities, trapping individuals in a paycheck-to-paycheck existence.

- Continued Poor Management: The stress and lack of resources often perpetuate poor financial habits, such as avoidance of financial responsibilities.

Chapter 2: Strategies for Breaking the Cycle

The first video titled "The Number One Thing That Keeps People Broke" discusses the vital role of money management habits in achieving financial success. It provides insights into how individuals can identify and rectify detrimental financial behaviors.

The second video, "10 Bad Money Habits That Were Keeping Me Broke," shares personal experiences and strategies to overcome poor financial practices, offering viewers practical steps toward financial wellness.

Section 2.1: Practical Steps Toward Financial Stability

To break free from poor money management, one must embrace a new mindset and adopt healthier financial practices. Here are some effective strategies:

- Establish and Maintain a Budget: Creating a realistic budget is fundamental for effective financial management. Track all income sources and categorize expenses, prioritizing necessities before discretionary spending. Regularly review and modify the budget as necessary.

- Build an Emergency Fund: Aim to save three to six months' worth of living expenses in an accessible account. This fund provides a safety net for unforeseen costs, reducing reliance on credit.

- Focus on Debt Repayment: Prioritize paying off high-interest debts quickly. Employ methods like the debt snowball (paying off the smallest debts first) or the debt avalanche (starting with the highest interest debts) for efficient debt reduction.

- Practice Delayed Gratification: Implement a waiting period before making significant purchases to distinguish between wants and needs, which helps minimize unnecessary expenses.

- Enhance Financial Knowledge: Improve your understanding of personal finance through books, online courses, or seminars. Familiarity with concepts like interest rates and investment strategies can empower better financial choices.

- Automate Savings and Payments: Set up automatic transfers to savings accounts and automate bill payments to ensure consistency in saving and timely payments.

- Seek Professional Guidance: Consulting a financial advisor can provide tailored advice and strategies for managing debt and making informed investment decisions.

- Adopt a Long-Term View: Understand that achieving financial stability is a gradual process. Concentrate on long-term objectives and remain patient, as consistent effort will yield positive results over time.

Section 2.2: Addressing Psychological Barriers

Overcoming poor money management also requires tackling psychological obstacles. Here are ways to address these issues:

- Identify Emotional Triggers: Recognize what prompts impulsive spending or poor financial choices. Common triggers can include stress or societal pressures. Developing healthier coping mechanisms can mitigate these impulses.

- Set Clear Financial Goals: Establish specific, attainable financial targets. Clear objectives, such as saving for a vacation or paying off a debt, can enhance motivation.

- Celebrate Small Achievements: Acknowledge progress, no matter how minor. Celebrating small wins can boost morale and reinforce positive financial habits.

- Foster a Positive Money Mindset: Transition from a scarcity mentality to one of abundance. Cultivating confidence in your financial management abilities can significantly influence your financial journey.

- Build a Supportive Community: Engage with individuals who share similar financial goals. Supportive groups can provide motivation and accountability.

Real-Life Examples of Success

Learning from the success stories of others can be both inspiring and instructive. Here are two individuals who transformed their financial lives:

- Sarah’s Financial Transformation: Sarah, a single mother, faced significant debt and financial instability. By creating a strict budget and eliminating unnecessary expenses, she utilized the debt snowball method to eliminate her debts. After attending financial workshops, Sarah paid off all her debts within three years, built a solid emergency fund, and began investing for her children's education.

- John’s Journey to Debt Freedom: Recent graduate John was overwhelmed with student loans and credit card debt. He proactively consolidated his debts and negotiated lower interest rates while adopting a minimalist lifestyle to cut costs. After taking a part-time job to increase his income, John became debt-free in five years and saved enough for a down payment on his first home.

Conclusion

Inadequate money management is a primary factor that keeps individuals trapped in financial hardship. However, by acknowledging this issue and actively working to enhance financial behaviors, it is possible to escape the cycle of poverty. Establishing a budget, building an emergency fund, prioritizing debt repayment, and improving financial literacy are crucial steps toward financial security. Additionally, addressing psychological barriers and fostering a positive mindset can greatly affect financial success. With dedication, education, and a long-term perspective, anyone can attain financial well-being and break free from poor money management habits.